Restaurant Industry Statistics:

Fast Casual Noodle | Online Traffic

This is a set of restaurant industry statistics on a fast-casual noodle restaurant digital ordering online traffic - Fei Siong Group.

Why are we focusing on online traffic (technology)?

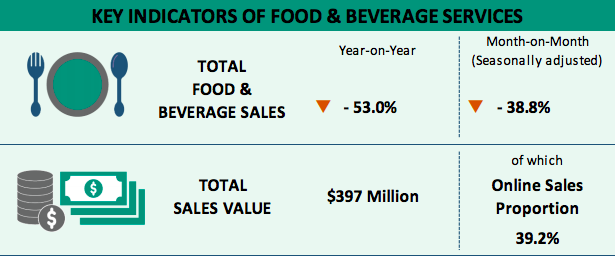

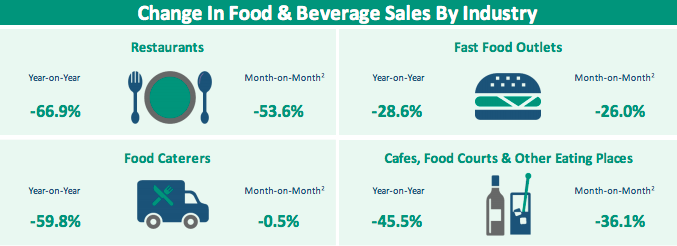

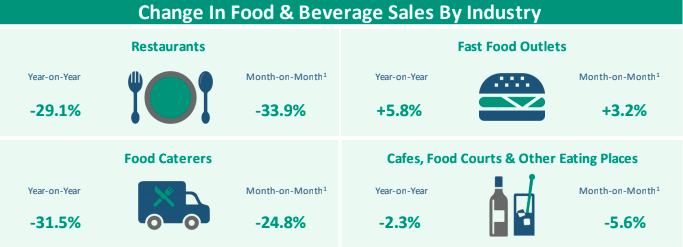

Referring to the industry statistics published by the Singapore Government (SingStats), using Feb 2020 and May 2020 as reference.

The food and beverage retail industry are in decline. This is due to COVID-19 situation and the lockdown in Singapore. However, the fast-food restaurant sector (QSR) reported a rise in business during the start of the COVID-19 period in February and also suffer a much lesser decline in May (taking note that MacDonald was only open in the middle of May).

Image below shows: May 2020 (below) and Feb 2020 (further below)

The fast-food industry better performance is mainly due to the stronger online presence because of their social media engagement and their established digital ordering.

Their capitalisation on the various forms of restaurant technology, be it online ordering or on-site touch screen ordering cushioned them against the COVID-19 impact.

Thus, we believe that the focus on technology, in this case online traffic and improving this area will aid food and beverage company to better their traffic and sales.

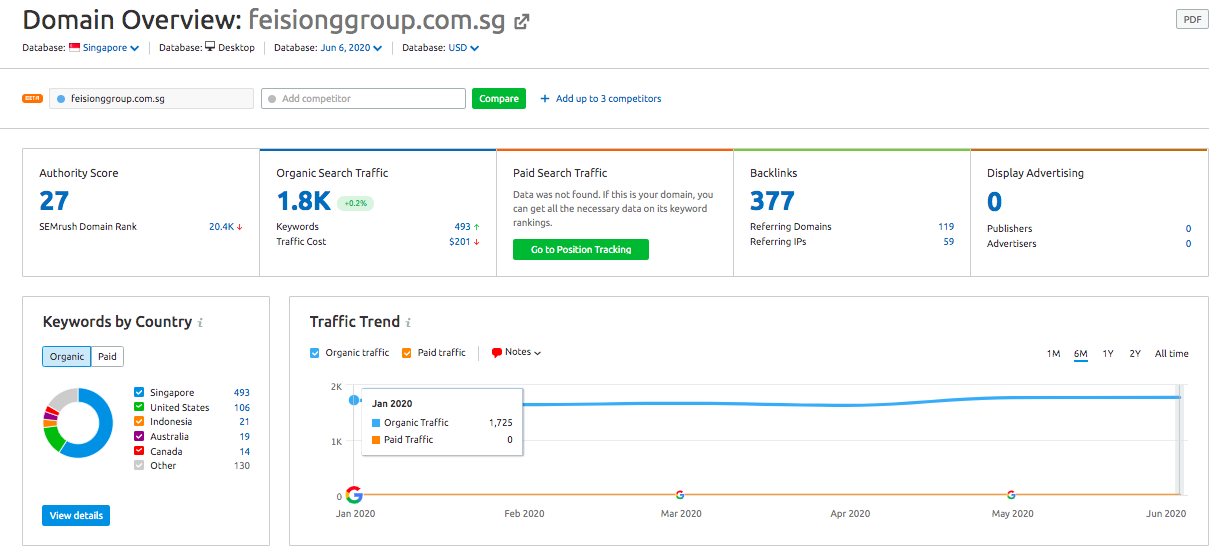

Research for: Fei Siong Group

In this report, we will assist the Fei Siong Group to identify the gaps in their online presence and their digital ordering. We are tracking the online traffic for the first six months of 2020 and for the online delivery platforms, we will based it on Foodpanda Singapore.

- Restaurant brand in focus: Fei Siong Group

- Restaurant presence: 157 outlets

- The country in focus: Singapore

- Statistics on: Online Traffic from January to June 2020

- Statistics from: Foodpanda Singapore

- Online Research Platform Used: SEMRUSH

Methodology used for this report

1. Tracking of Fei Siong organic/paid traffic versus its competitors.

- In this section, we will compare the organic traffic between Fei Siong main website and their identified competitors.

2. Tracking of Fei Siong competitors based on online delivery platform: Foodpanda Singapore (advertisements)

- In this section, we will identify the competitors that are doing digital ordering with advertisement from East Point Mall and also similar genre competitors.

3. Tracking of Fei Siong competitors based on online delivery platform: Foodpanda Singapore (organic searches)

- In this section, we track the keywords/competitors that people searched that resulted in a visit to Foodpanda Singapore.

1. Tracking of Fei Siong organic/paid traffic versus its competitors

In this section, we are tracking the competitors against Fei Siong Group online traffic. The food and beverage competitors are identified by Fei Siong Group. The food and beverage groups that we are tracking:

- Breadtalk

- Kou Fu

- Kimly

- Kopitiam Group

Online Traffic Statistics:

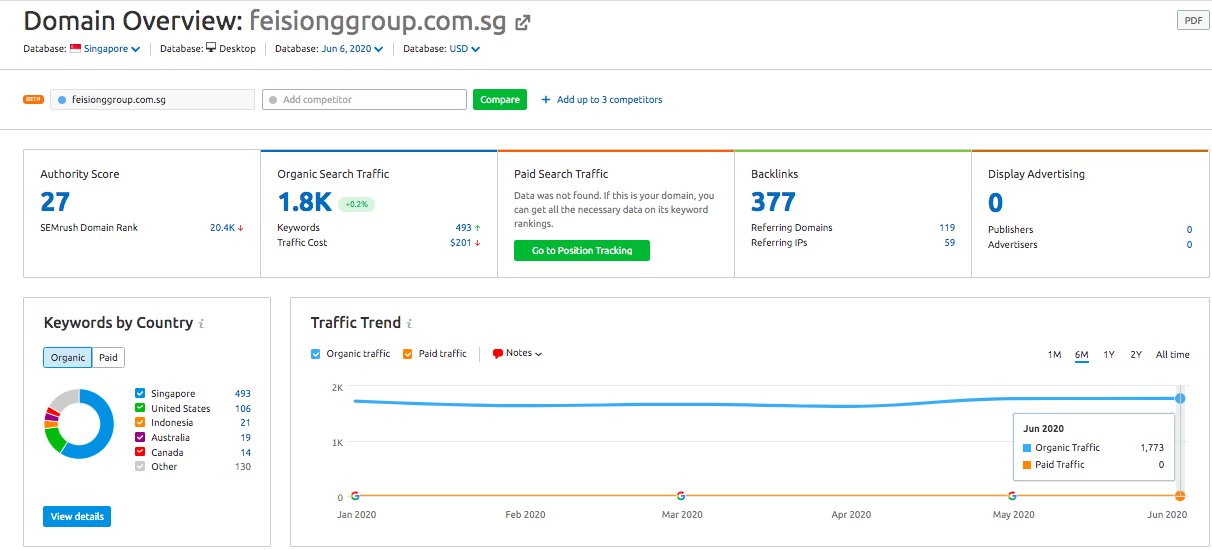

Fei Siong Group Online Traffic from January to June 2020 is holding steady at 1700.

Online Traffic Statistics:

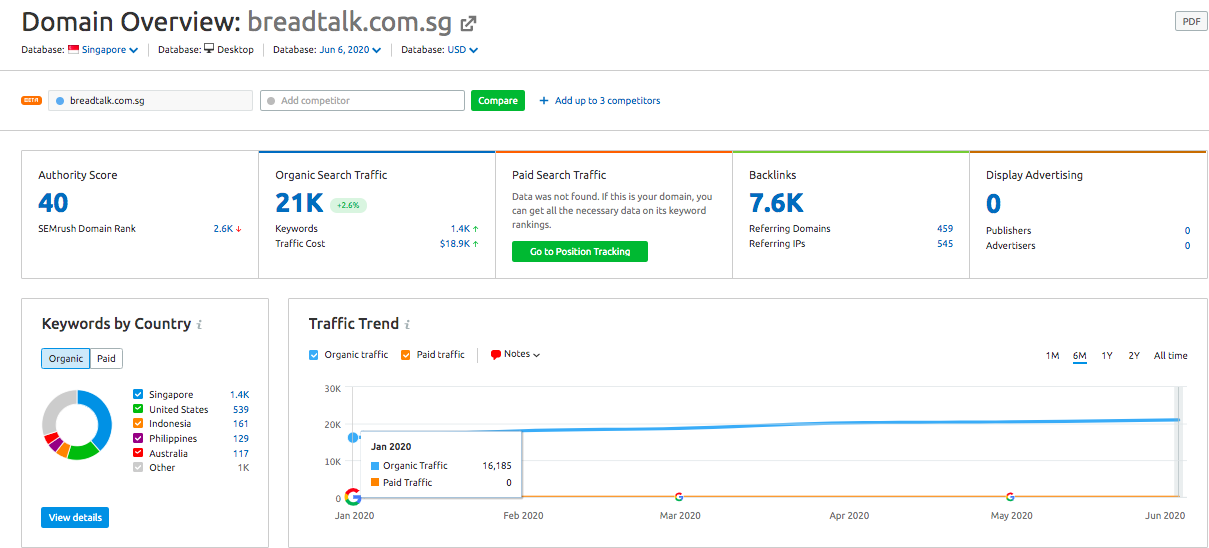

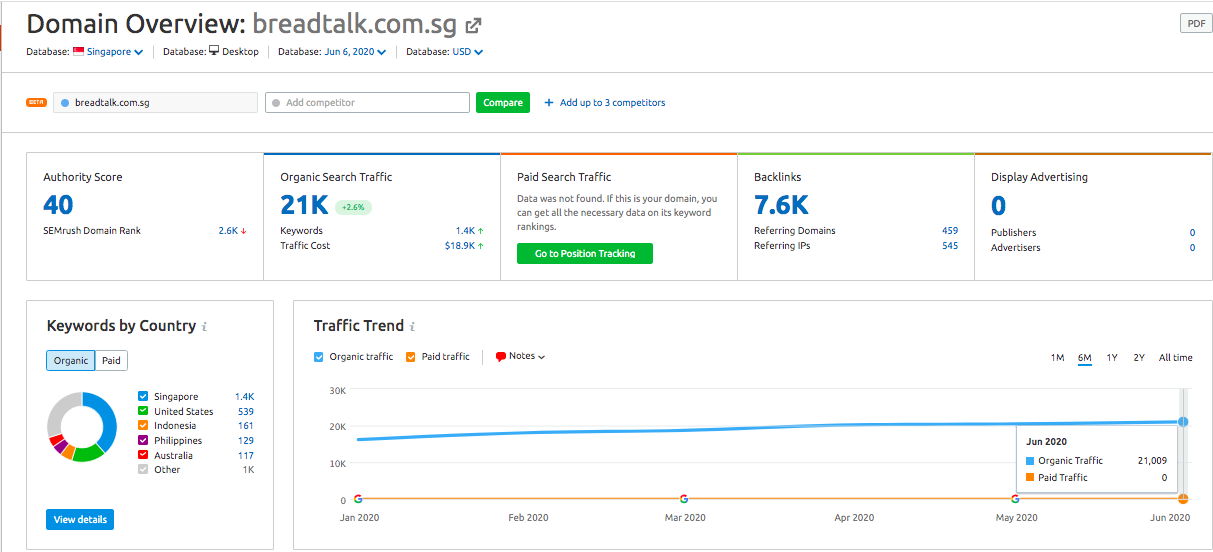

Breadtalk online traffic grew from 16 000 in January 2020 to 21 000 in June 2020.

Online Traffic Statistics:

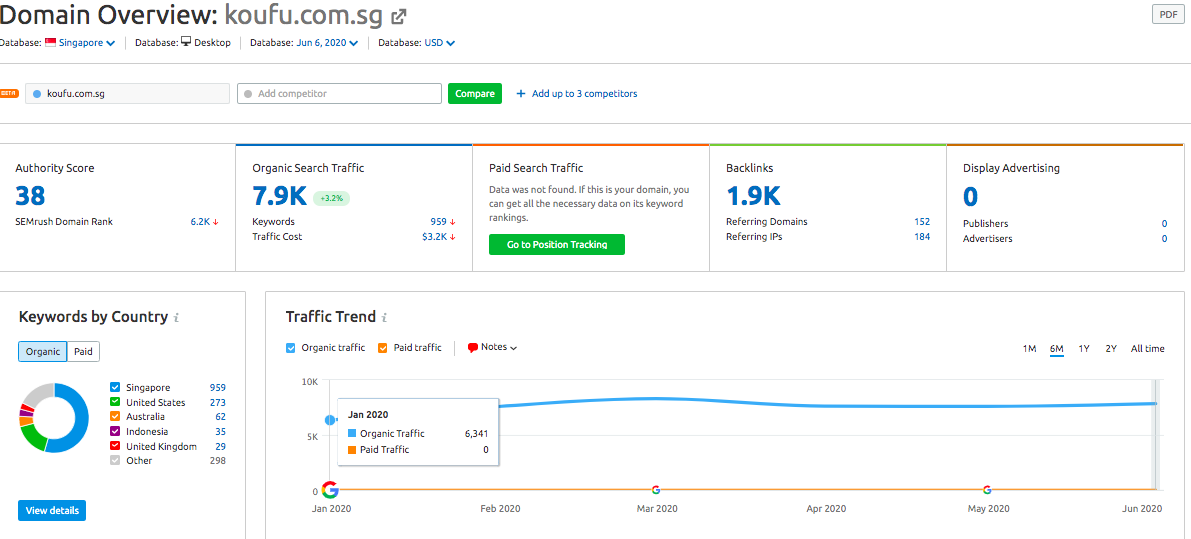

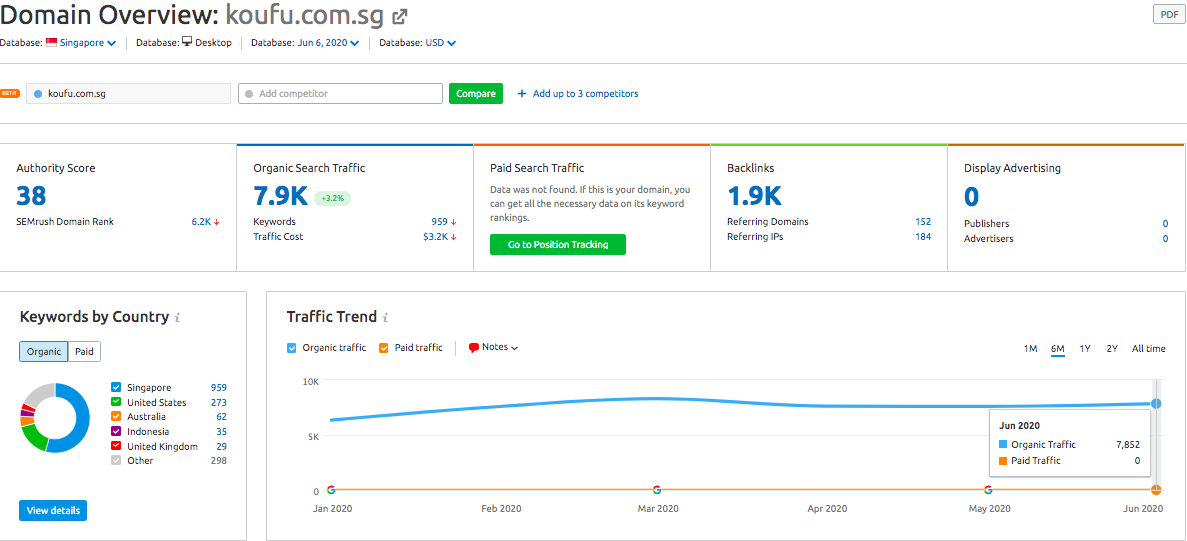

Koufu online traffic grew from 6300 in January 2020 to 7800 in June 2020.

Online Traffic Statistics:

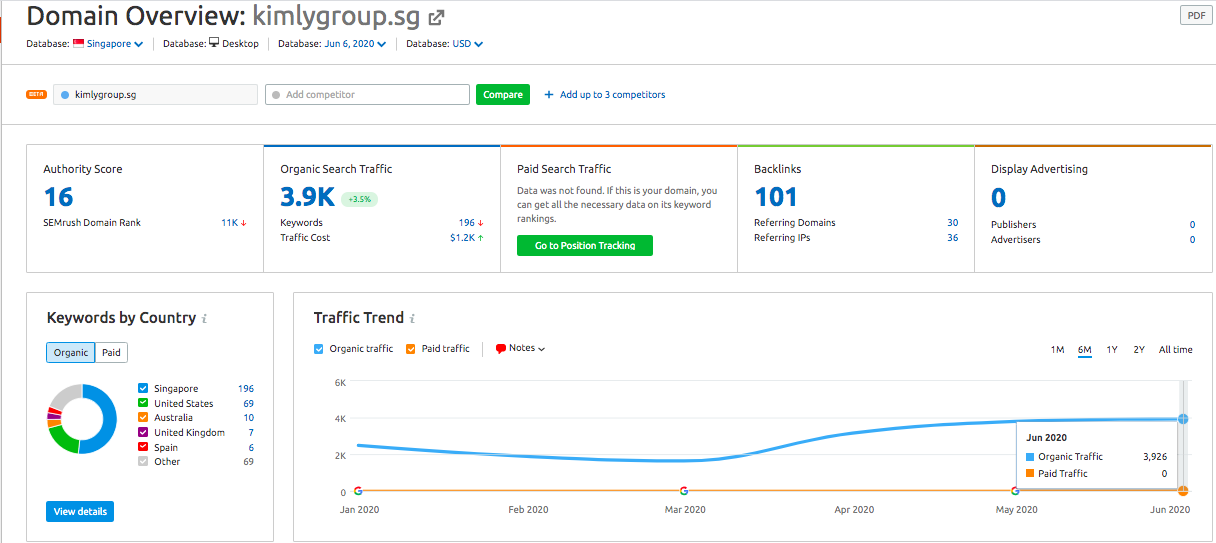

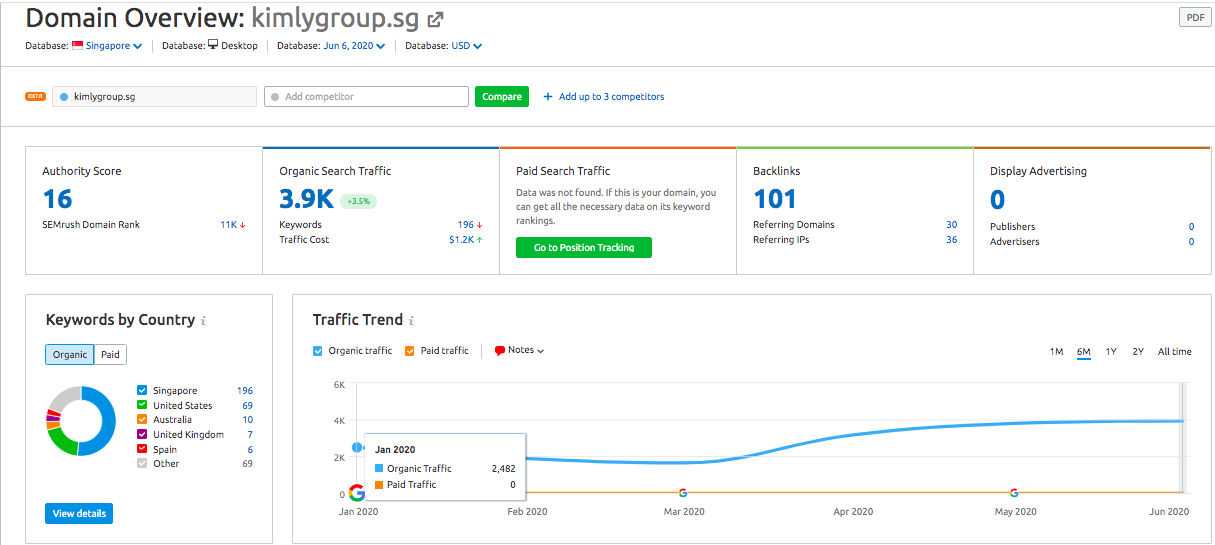

Kimly online traffic grew from 2400 in January 2020 to 3900 in June 2020. Kimly online traffic spike from March 2020.

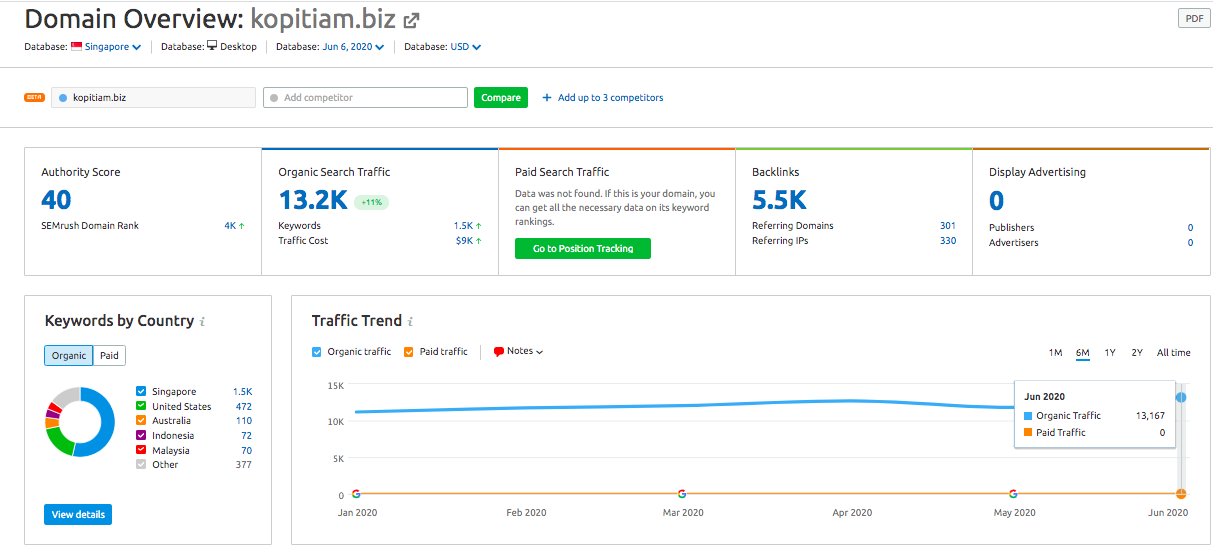

Online Traffic Statistics:

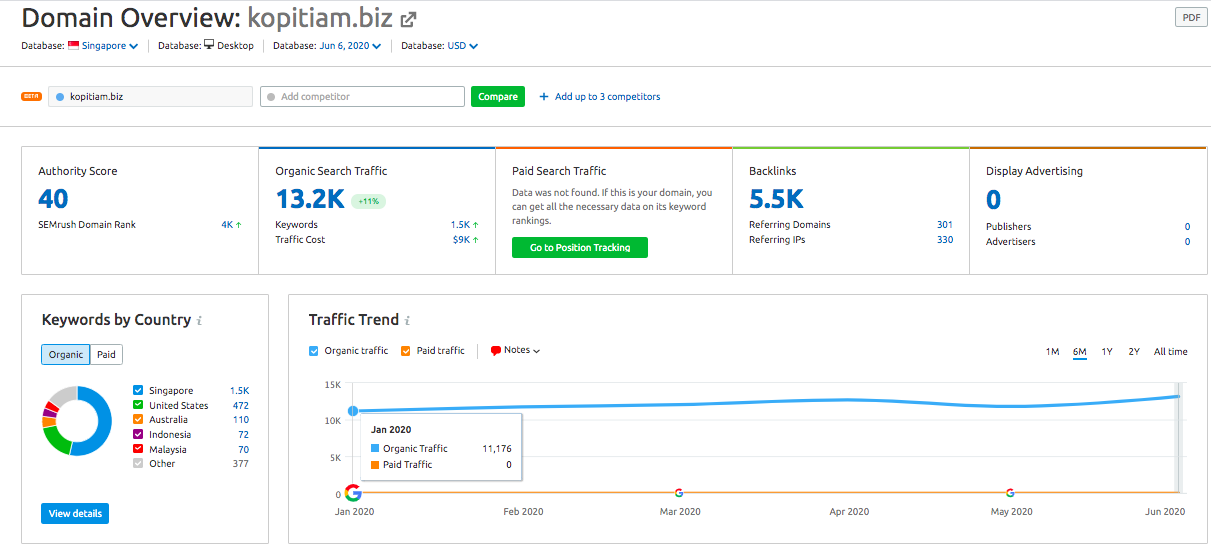

Kopitiam online traffic grew from 11 000 in January 2020 to 13 000 in June 2020.

Summary:

- None of the F&B group registered any loss in online traffic.

- None of the competitors is doing search advertising.

- All the identified competitors grew in their online traffic (other than Fei Siong Group)

- Breadtalk has the strongest online presence as of June 2020.

Some things to consider:

- Why are all the competitors enjoying growth in their online traffic?

- If they are not using search advertising, what are their traffic drivers?

- Are the consistent traffic that Fei Siong enjoy, their regular customers or monthly influx of NTB (New to Business).

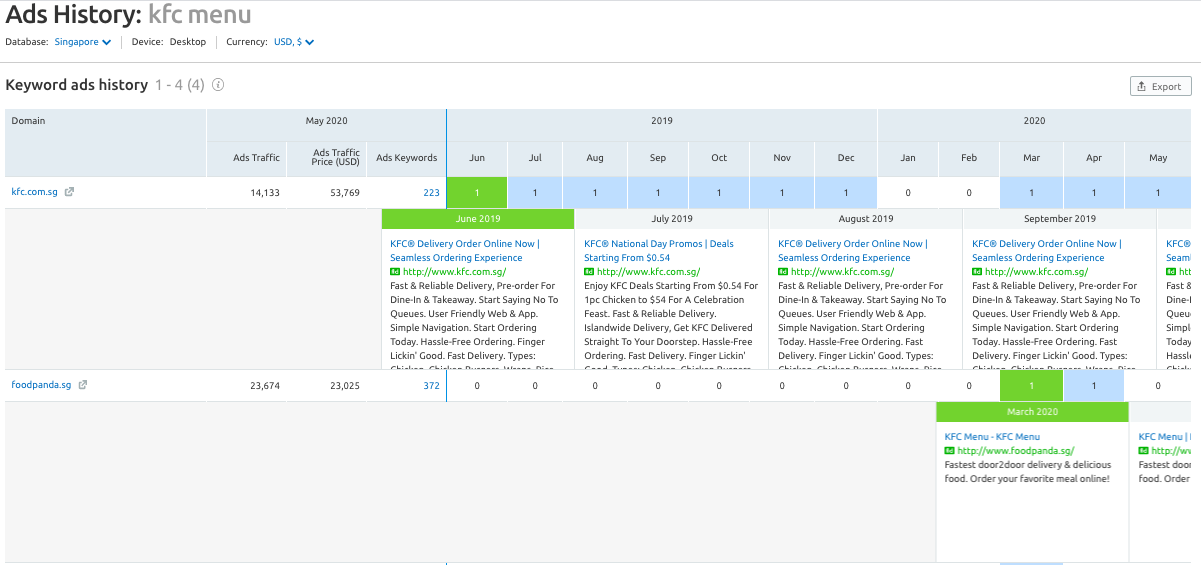

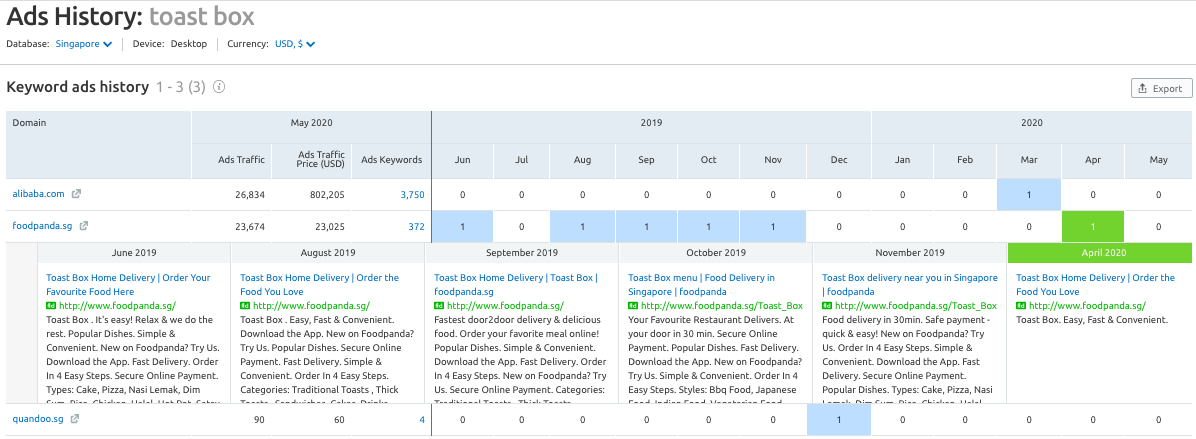

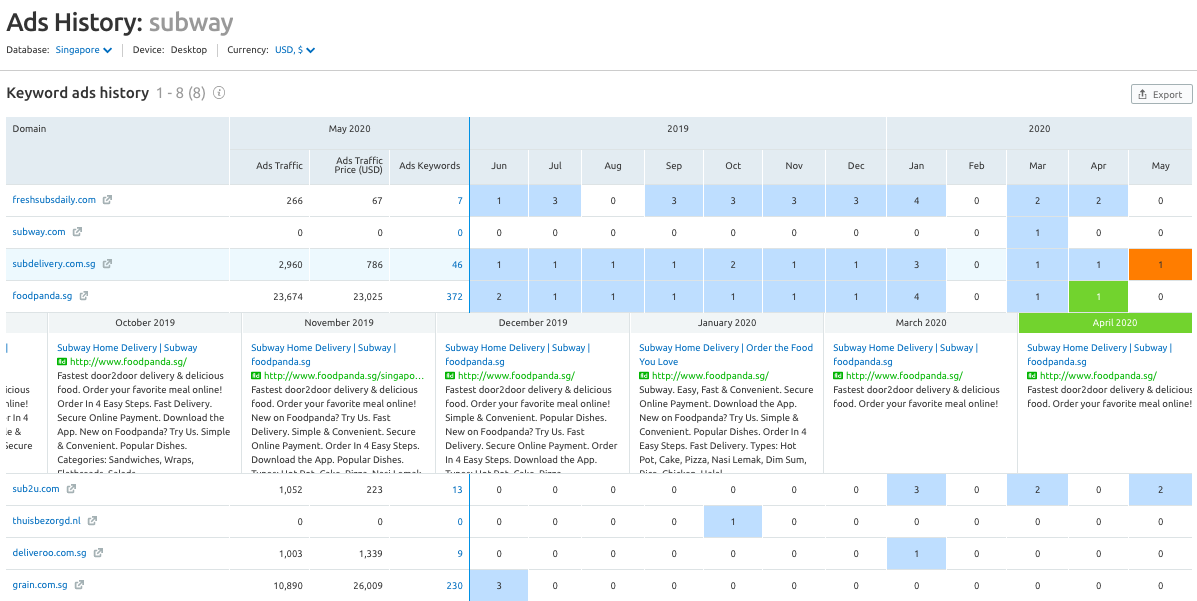

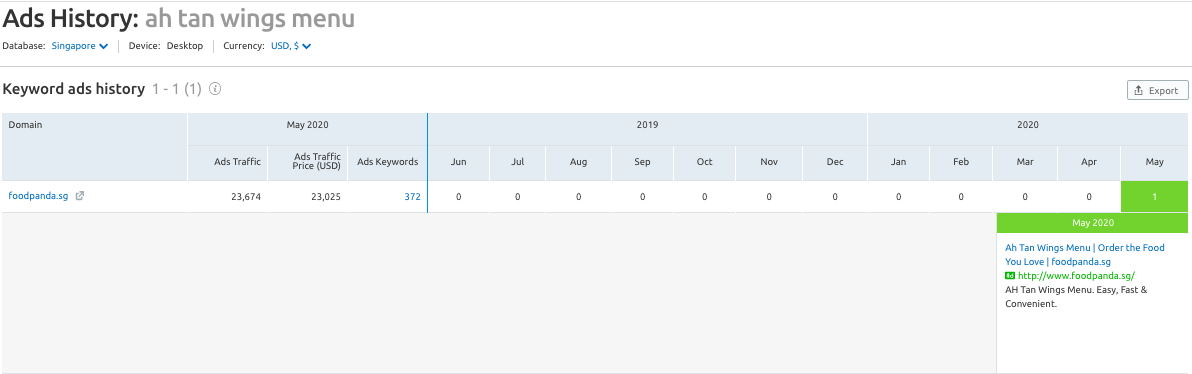

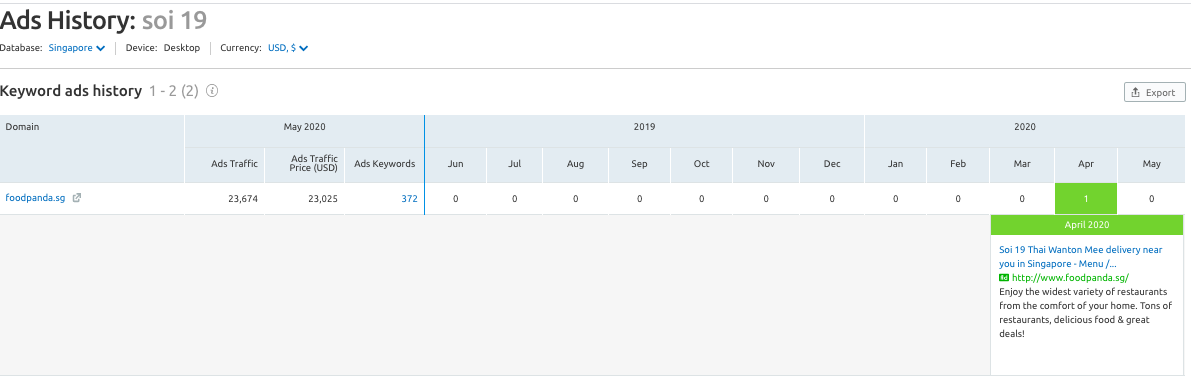

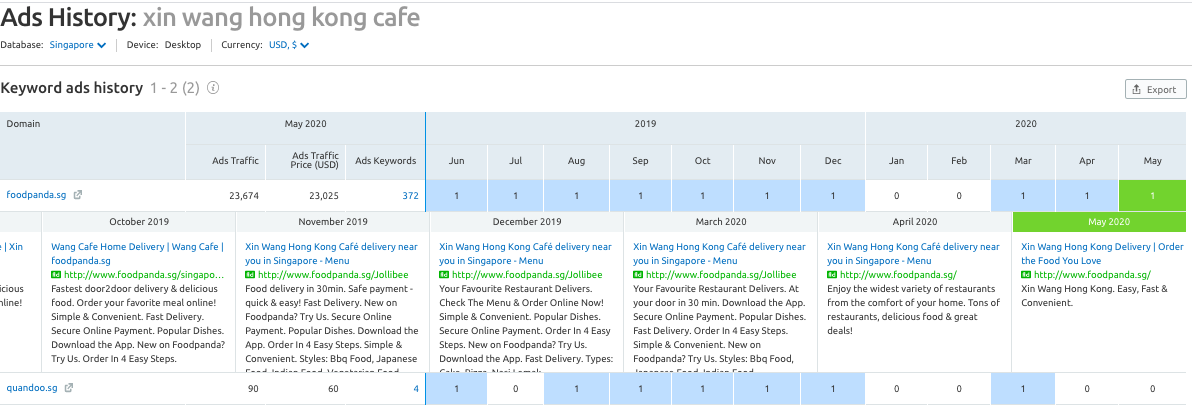

Tracking of Fei Siong competitors based on online delivery platform: Foodpanda Singapore (advertisement)

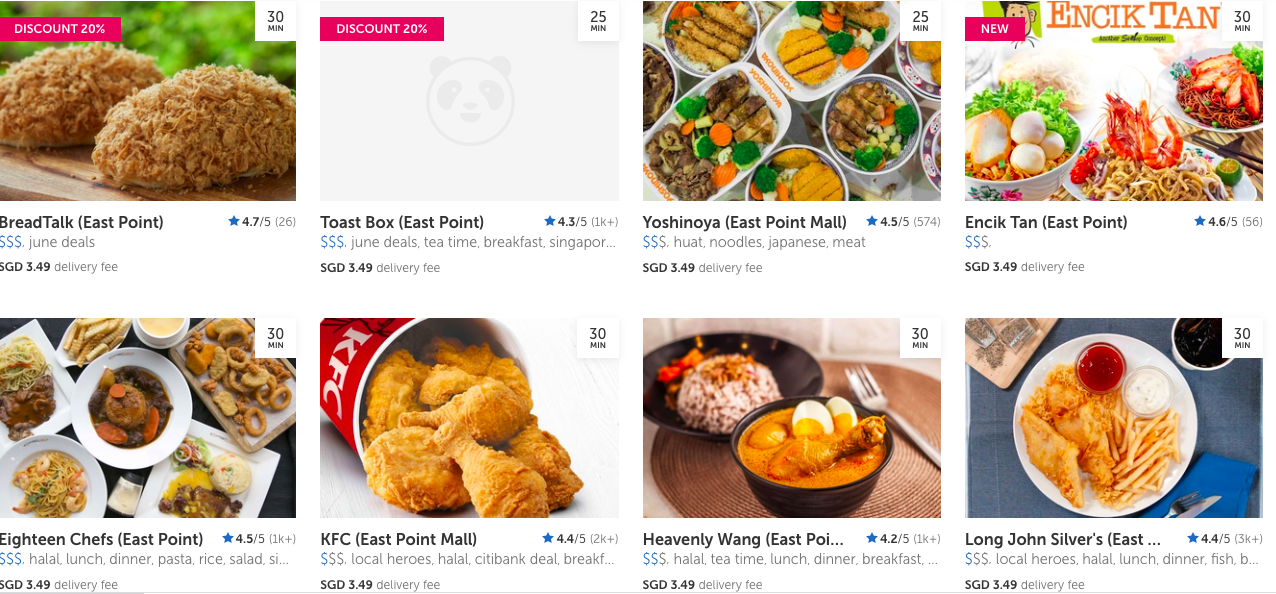

In this section, we highlight the competition that Fei Siong F&B brands faced in their online delivery platform Foodpanda Singapore.

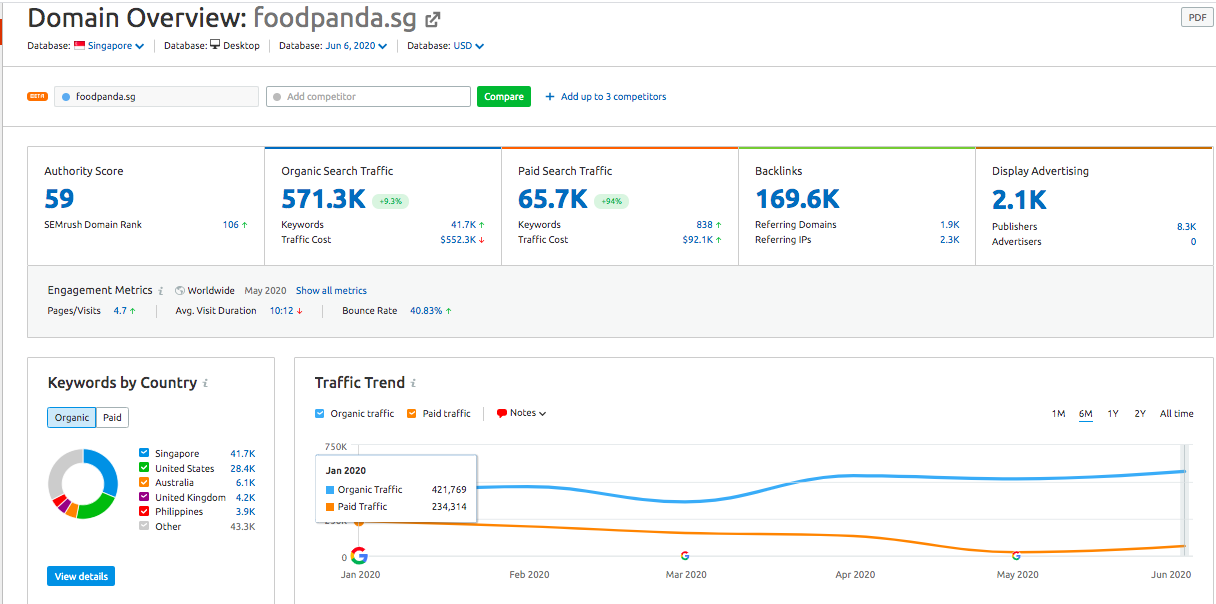

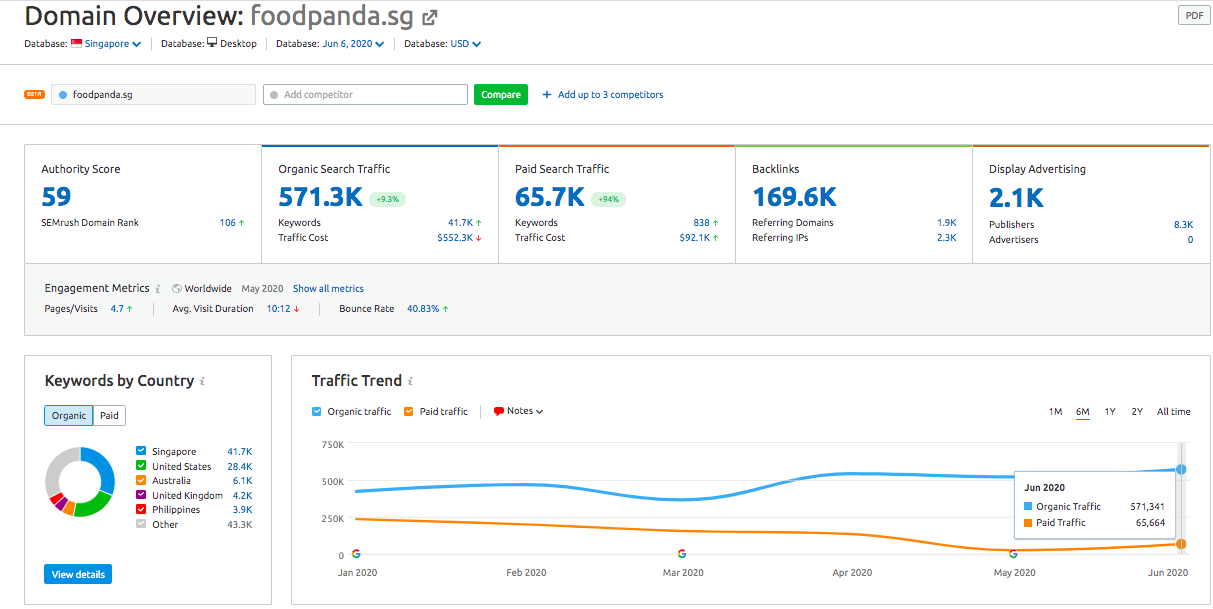

The overall online traffic for Foodpanda in Singapore is slightly more than 600K, tracked till June 2020.

East Point Mall: Competing restaurants that are advertising online in the same trading area.

Assumption: The online advertisement is done for the whole Singapore, so a shopper in this locality will be considered one of the target audience.

Similar category: Restaurants we classified as a similar category that are also advertising online.

Summary:

- Most of the quick service restaurants are advertising

- F&B brands (category) similar to Fei Siong is also advertising.

- We did not capture any Fei Siong Group advertising on Foodpanda Singapore platform or any other platforms

Some things to consider:

- Would Fei Siong F&B brands traffic and sales be affected (on Foodpanda Singapore) with these advertisements?

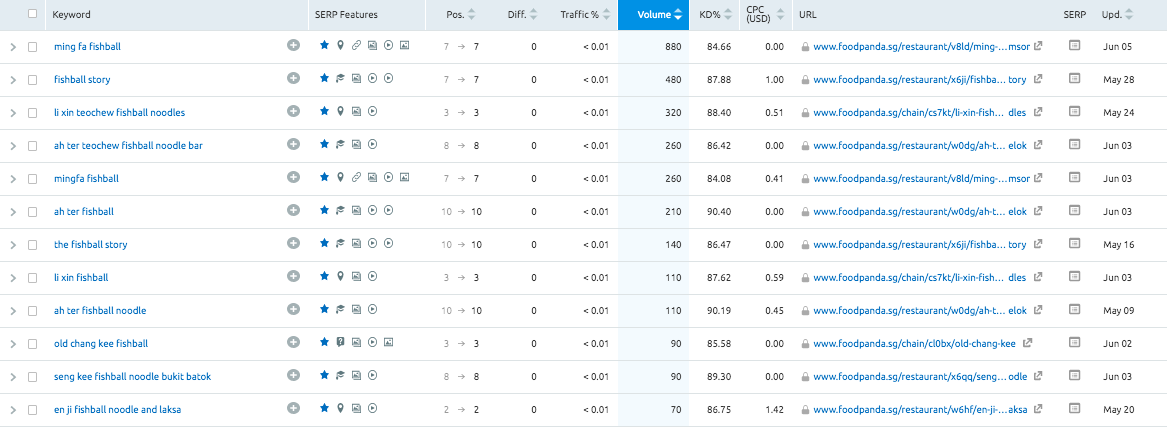

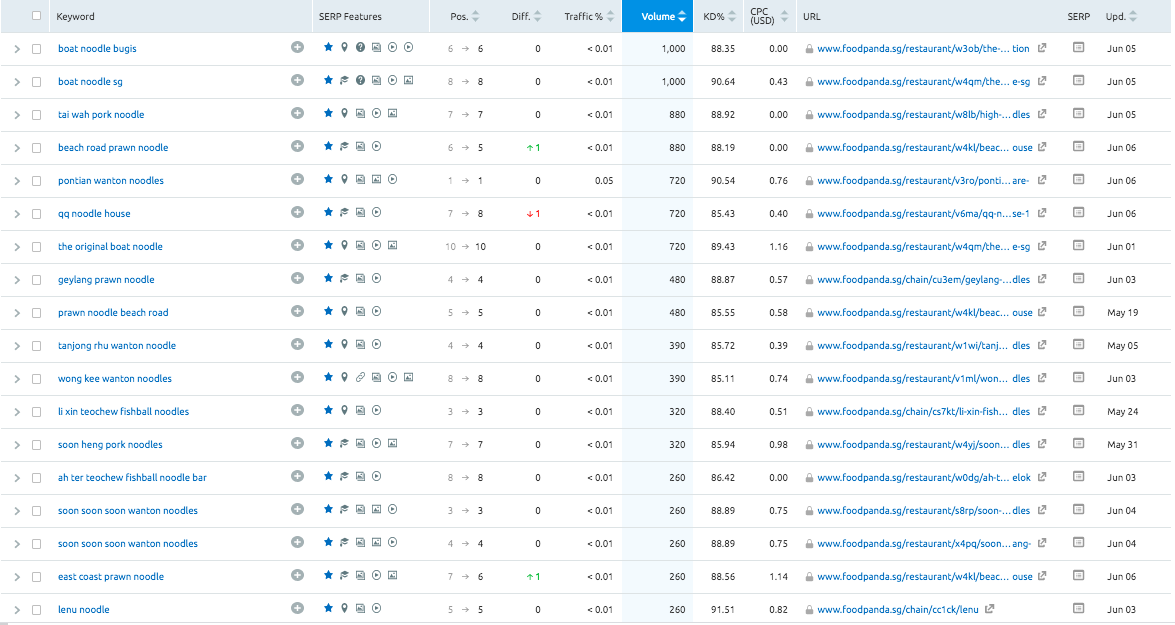

Tracking of Fei Siong competitors based on the genre/type of food

In this section, we tracked the organic search that resulted in a visit to Foodpanda Singapore.

Assumption: We make the assumptions of choosing keywords based on Fei Siong Group type/genre of food:

- Fishball

- Noodle

Summary:

An absence of Fei Siong brands in fishball related organic search.

An absence of Fei Siong brands in noodle related organic search.

Some things to consider:

Would Fei Siong brands' traffic and sales have an uplift (on Foodpanda Singapore) if they are found for these search terms?

Recommendations

Leveraging on assets:

We noticed that each brand has its own social media presence (Facebook) and location presence (Google Map), can consider:

- Targeted advertisement to transaction destination (e.g. Foodpanda Singapore )

- Can consider featured promotion on online ordering platforms

Awareness program:

To consider using the physical location to garner user-generated content to increase Fei Siong brand visibility:

- A unique marketing campaign to garner user/customer posts on Facebook, Instagram, e.g. time-based rewards campaign

- A trending topic to garner conversation on various sites, forums and social media, e.g. sustainability

Food and Beverage Marketing Resources

A Guide to Restaurant Marketing - various case case studies on how OCM assist restaurants, cafes, coffee shops in driving traffic or awareness. Also showcase, the tools and platforms (online and offline) that OCM leverages on in assisting the food and beverage outlets.

About US | OCM Profile

OCM (OnCoffeeMakers.com) was started in 2007 with the first webpage about coffee machines. And for a number of years, we focused on helping people find their desired coffee machine (we still are helping folks with that! So, if you are looking for coffee machines for office or restaurants - check out the link).

In 2010, we started getting enquiries on restaurant marketing and we start to help food and beverage brands with their marketing. Below are campaigns and events that we have done over the years:

OCM's campaigns: F&B Marketing Ideas by OCM

OCM's Events: F&B Industry events by or with OCM

Check out this restaurant marketing guide to learn more about the many campaigns and companies we have worked with.

Since then, we have also created many marketing workshops and classes for the F&B industry. Many of these modules are still running in tertiary institutions such as Temasek Polytechnic Skillsfuture Academy and also ITE College East COC classes, below are some snippets of our lectures and workshops:

OCM’s F&B workshops: Food and Beverage Marketing Lectures | Workshops - click to watch classes on customer journey map, JTBD and more.

So, if you are looking for industry practitioners to help you scale your coffee or F&B businesses, do drop us a message or book an appointment. Do also check out our various social media platforms on regular F&B and coffee market updates:

For regular coffee (F&B) related videos: OCM Youtube

For Daily Coffee Inspiration (fun coffee content): OCM IG

For insights into the coffee (F&B) industry: OCM LinkedIN

PS: For the coffee lovers, we continue to share coffee articles (and videos) and have also started a free coffee class section (with free online coffee training supported by coffee partners).